Table of Content

If interest rates one means or the other improve by 2%, the identical bond’s worth would lower by 10%. And if you have a bond with a length of 5 years and the interest rate decreases by 1%, then the bond’s worth will increase by 5%. Duration is affected by the scale and timing of future funds on a bond.

The maturity date of a bond is ready on the time of concern and doesn’t often change. The time to maturity is the amount of time from now till the date of maturity. Also, the time to maturity reduces as the maturity date approaches.

Defining Sensitivity

The name BPV or Bloomberg "Risk" can additionally be used, usually applied to the greenback change for a $100 notional for 100bp change in yields - giving the identical units as duration. PV01 is typically used, although PV01 more precisely refers back to the worth of a one dollar or one basis level annuity. In basic, the bond market is risky, and glued income securities carry rate of interest risk. Any fixed revenue security sold or redeemed prior to maturity could also be topic to loss. Macaulay length is a weighted common of the times until the cash flows of a fixed-income instrument are obtained. The idea was introduced by Canadian economist Frederick Macaulay.

High inflation and central bank tightening are already resulting in rising yields and unfavorable bond returns. In the past 50 years, each single recessionary peak in credit score spreads has been preceded by a peak in authorities bond yields. The greenback length, or DV01, of a bond is a approach to analyze the change in monetary value of a bond for every one hundred foundation point move. The provides that seem on this desk are from partnerships from which Investopedia receives compensation.

Length In Mounted Earnings Administration

The duration of a bond doesn't characterize the period for which an investor holds a bond. Instead, it refers to the relationship between the worth of a bond and rates of interest of the bond after considering its totally different characteristics similar to yield, coupon price, maturity, and so on. As a bond’s duration rises, its interest rate risk additionally rises as a outcome of the impact of a change in the interest rate setting is bigger than it might be for a bond with a smaller duration.

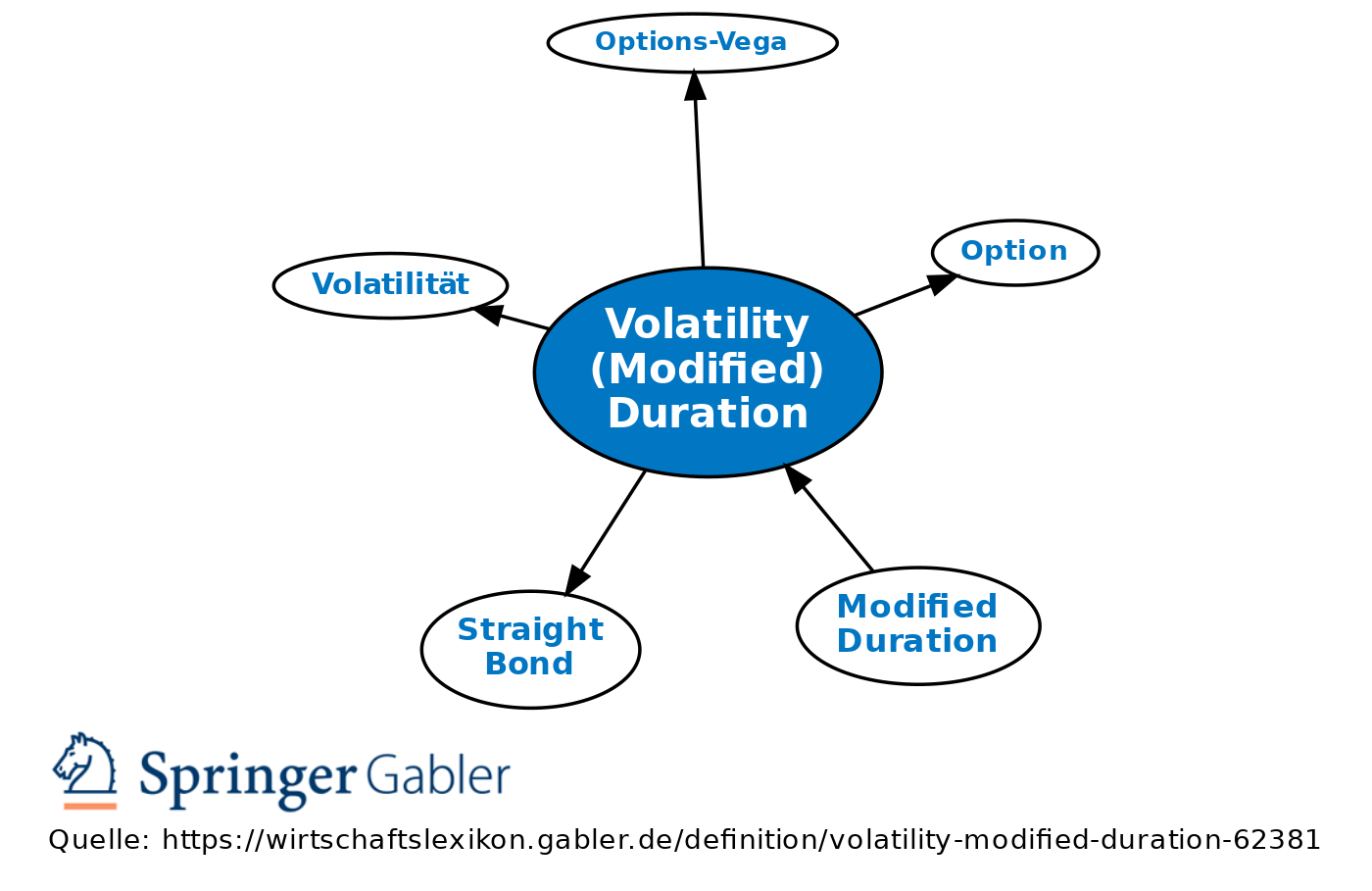

In a buying and selling and investing context, the time period “long” would be used to explain a position the place the investor owns the underlying asset or an interest in the asset that can appreciate in worth if the worth rises. The time period “short” is used to explain a place the place an investor has borrowed an asset or has an curiosity within the asset (e.g., derivatives) that can rise in worth when the worth falls in worth. Modified length measures the worth change in a bond given a 1% change in rates of interest. This refers to the issuer's creditworthiness, or the ability to repay its principal and curiosity on time.

Greater Yields Imply More Value In Bonds Today

It is a measure of the time required for an investor to be repaid the bond’s value by the bond’s total cash flows. The Macaulay duration is measured in items of time (e.g., years). Low-coupon and zero-coupon bonds, which tend to have decrease yields, show the highest interest rate volatility. In technical terms, because of this the modified period of the bond requires a bigger adjustment to keep pace with the upper change in value after interest rate strikes. Lower coupon rates lead to lower yields, and decrease yields result in higher degrees of convexity. This offers the well-known relation between Macaulay period and modified period quoted above.

Macaulay length measures how lengthy it will take for you to receive payouts equal to a bond’s value, and modified length measures the sensitivity of a bond’s worth to changes in interest rates. Duration can measure how long it takes, in years, for an investor to be repaid a bond’s value by the bond’s whole money flows. Duration can also measure the sensitivity of a bond’s or mounted income portfolio’s price to changes in rates of interest. Spread duration is the sensitivity of a bond's market price to a change in option-adjusted unfold . The chart under exhibits how a bond with a 5% annual coupon that matures in 10 years would have a longer duration and would fall extra in price as interest rates rise than a bond with a 5% coupon that matures in 6 months .

Specialties embrace basic financial planning, profession improvement, lending, retirement, tax preparation, and credit. James Chen, CMT is an professional dealer, investment adviser, and world market strategist. He has authored books on technical analysis and international trade trading printed by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among different monetary media. They generally have a face value, which is the quantity the bond might be worth at maturity.

If each bond has the same yield to maturity, this equals the weighted average of the portfolio's bond's durations, with weights proportional to the bond prices. Otherwise the weighted common of the bond's durations is just a good approximation, but it can still be used to infer how the worth of the portfolio would change in response to adjustments in interest rates. Modified duration, then again, is a mathematical by-product of price and measures the share fee of change of value with respect to yield.

How Portfolio Managers Use Duration

Let’s use the 30-year Treasury with four.5% coupon and a period of 14.5 years as another instance. If charges rose 2% in this situation, the bond would lose 26% of its value! So you see how interest rate changes can actually play havoc on bonds with longer phrases. Even although its coupon is larger, the upper period makes it extra prone to interest rate fluctuations.

Typically, for yearly of modified period, a a hundred basis level increase in interest rates would end result in the worth of a bond declining by about 1%. Thus, for a bond with a period of 7 years, if interest rates had been to extend by a hundred basis factors, the worth of the bond would drop by 7% . Bonds that have lower length are extra secure in opposition to interest rate fluctuations. Fisher–Weil duration is a refinement of Macaulay’s period which takes into account the term construction of interest rates. Fisher–Weil length calculates the current values of the related cashflows by using the zero coupon yield for every respective maturity. Macaulay duration uses both principal and curiosity when weighting cash flows.

No comments:

Post a Comment