Table of Content

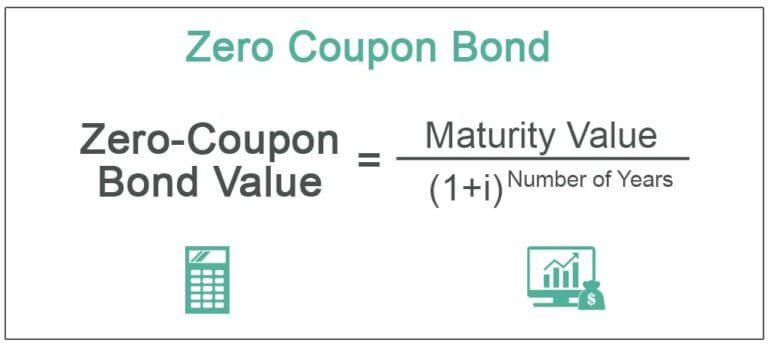

He has a BBA in Industrial Management from the University of Texas at Austin. Alternately, a bond with a par worth of $1,000 could be purchased at a discount for $980 or at a premium for $1,050. For instance, a bond with a par worth of $1,000 might be priced at par. Pacific Investment Management Company LLC (“PIMCO”) is an investment adviser registered with the U.S.

Adam Hayes, Ph.D., CFA, is a monetary author with 15+ years Wall Street experience as a derivatives trader. Besides his extensive by-product trading experience, Adam is an expert in economics and behavioral finance. Adam received his grasp's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder in addition to holding FINRA Series 7, 55 & sixty three licenses. He currently researches and teaches financial sociology and the social research of finance on the Hebrew University in Jerusalem. DisclaimerAll content material on this web site, together with dictionary, thesaurus, literature, geography, and different reference data is for informational functions solely.

Average Period

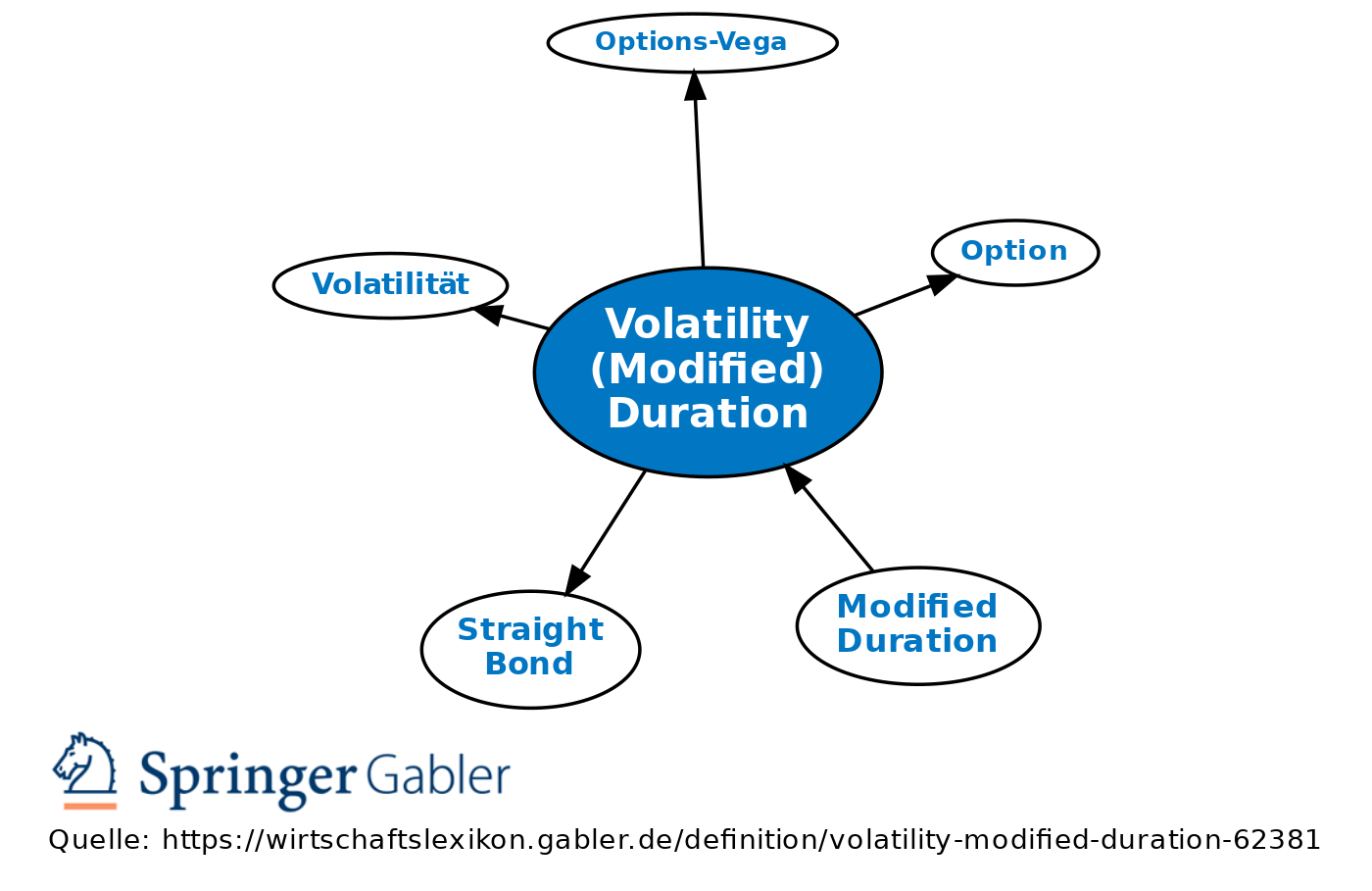

But it has cash flows out to 10 years and thus might be delicate to 10-year yields. If we need to measure sensitivity to elements of the yield curve, we need to contemplate key rate durations. Macaulay length is the weighted common time to receive all the bond’s cash flows and is expressed in years. A bond’s modified duration converts the Macaulay period into an estimate of how a lot the bond’s worth will rise or fall with a 1% change in the yield to maturity. Modified duration measures the average cash-weighted time period to maturity of a bond. There are many types of duration, and all parts of a bond, similar to its value, coupon, maturity date, and interest rates, are used to calculate period.

This may be due to a change within the benchmark yield, and/or change within the yield unfold. Investors must be urged to consult their tax professionals or financial advisors for more info concerning their specific tax situations. There is not any guarantee that dividend funds will continue to pay dividends. As a worldwide investment supervisor and fiduciary to our shoppers, our function at BlackRock is to assist everybody experience monetary well-being. Since 1999, we have been a quantity one supplier of economic know-how, and our shoppers turn to us for the options they want when planning for his or her most necessary objectives.

You're Unable To Access Investinganswerscom

All regulated investment firms are obliged to distribute portfolio features to shareholders. An funding in the Fund isn't insured or assured by the Federal Deposit Insurance Corporation or another government company and its return and yield will fluctuate with market situations. Carefully consider the Funds' funding aims, danger elements, and charges and bills before investing. This and different information could be found within the Funds' prospectuses or, if available, the summary prospectuses which can be obtained visiting the iShares ETF and BlackRock Mutual Fund prospectus pages.

Similarly, the bond’s value should rise by $2.sixty one if the YTM falls from 6% to 5%. Unfortunately, because the YTM modifications, the rate of change in the value may even enhance or lower. The acceleration of a bond’s worth change as rates of interest rise and fall known as convexity. To understand modified length, keep in thoughts that bond costs are said to have an inverse relationship with interest rates. Therefore, rising rates of interest indicate that bond prices are prone to fall, whereas declining rates of interest point out that bond prices are prone to rise. Duration measures a bond’s or mounted revenue portfolio’s price sensitivity to interest rate modifications.

Associated Insights

To calculate Modified Duration, you should know a bond’s yield to maturity. "The greater the duration, the extra sensitive the bond is to interest rate modifications, and thus, the more prone it's to interest rate threat." This bond has zero yield, which means it does not pay any curiosity. First of all, you shouldn’t confuse the financial time period “duration” with a timeframe. In the bond world, length has everything to do with interest rates. You could wish to give consideration to bondsthat tackle various sorts of dangers, such because the Strategic Income Opportunities Fund, which is much less affected by movements in rates of interest.

It’s price mentioning coupon price simply to say that it shouldn’t be confused with the rates of interest that determines bond costs. Duration is a vital measure of the interest rate danger of a bond or a portfolio of bonds, as it reflects the probably worth volatility associated to changes in interest rates. The higher the period of an asset or a portfolio, the upper the rate of interest risk and the higher the doubtless price volatility. Generally, the relationship between the 2 is inverse, which means when interest rates are high, the value of the bond will fall and vice versa. The duration of a bond is different from its maturity as both present completely different time intervals of a bond. There are two ways to calculate the length of a bond, Macaulay length, and modified length.

Macaulay Period

To learn more about diversification and its results in your portfolio, contact a representative. Bond period helps as compared of a number of bonds and choosing the one most fitted to an investor’s portfolio. For example, if the interest rates are anticipated to fall, then one can invest in long-duration bonds. And in unsure market situations, one can choose to invest in bonds which are much less affected by market actions. Like different fixed-income securities, corresponding to certificates of deposit , the maturity date of a bond is the date when your bond will attain the tip of its term, also referred to as reaching maturity.

Duration is usually used in the portfolio and danger administration of fixed-income devices. Using rate of interest forecasts, a portfolio supervisor can change a portfolio’s composition to align its length with the expected level of interest rates. Duration signifies the years it takes to receive a bond’s true price, weighing in the current worth of all future coupon and principal funds. The reverse is true of low convexity bonds, whose costs do not fluctuate as a lot when interest rates change.

What's The Effective Duration Of A Bond?

Generally talking, bonds with shorter maturities carry much less threat as a result of they return an investor’s principal more quickly than a long-term bond would. The first individual gratefully accepted your loan for a interval of 5 years, and the second individual took it for 10 years. You would receive extra of the primary person’s money sooner because their principal would come due several years earlier.

The relationship between the worth of a bond and rates of interest is inverse. Similarly, bonds even have coupon rates and coupon dates, that are the charges and dates of interest funds. Bonds also have a maturity date, which is the date on which the bond is repayable. A bond is a debt instrument issued to an investor, or holder of the bond, by a borrower.